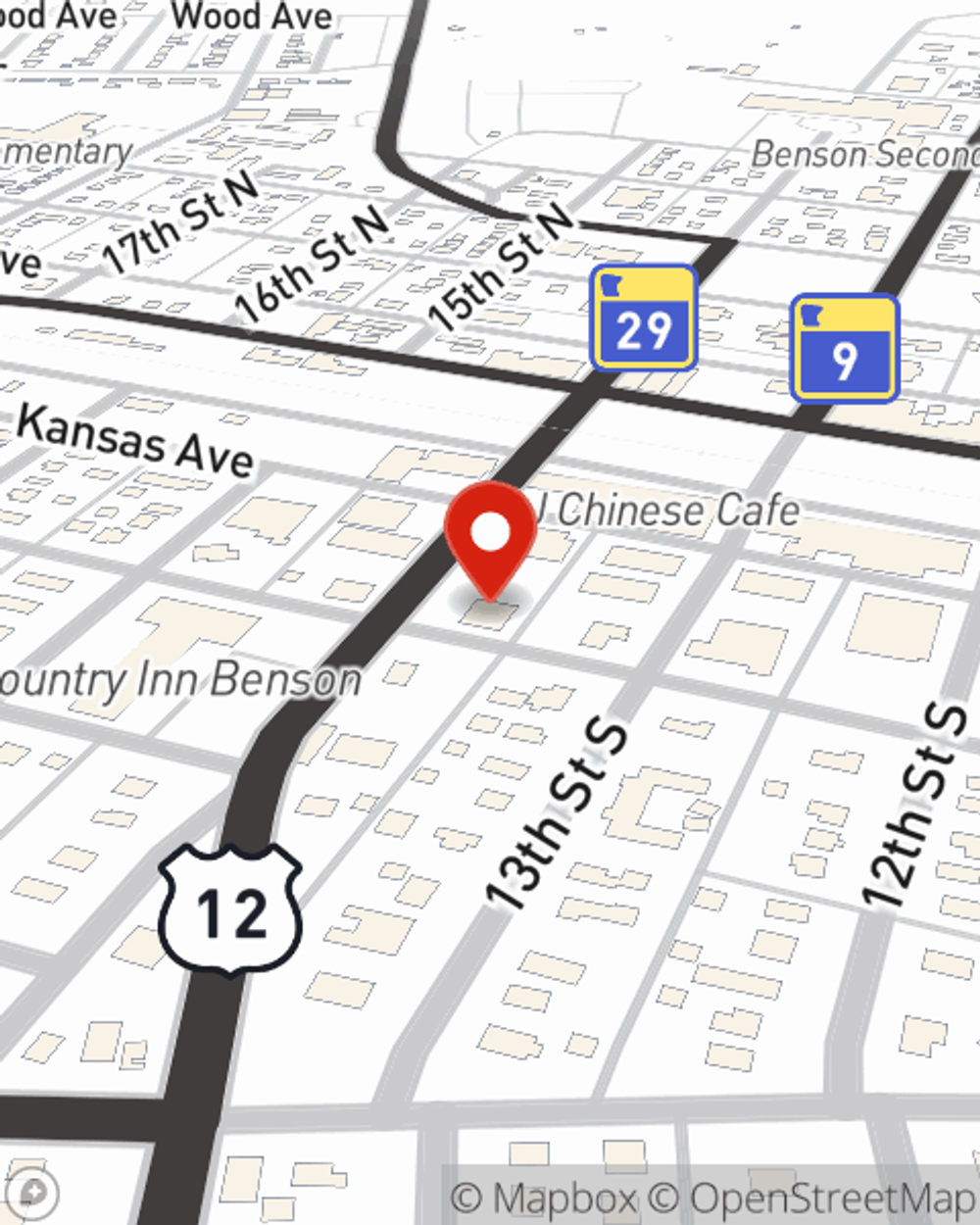

Renters Insurance in and around Benson

Welcome, home & apartment renters of Benson!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented property or apartment, you should have renters insurance—whether or not your landlord requires it. It's coverage for the things you do own, like your hiking shoes and running shoes... even your security blanket. You'll get that with renters insurance from State Farm. Agent Mick Quinn can roll out the welcome mat with the knowledge and skill to help you determine how much coverage you need. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Welcome, home & apartment renters of Benson!

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a condo or apartment, you still own plenty of property and personal items—such as a tablet, stereo, bicycle, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Mick Quinn? You need an agent who can help you examine your needs and evaluate your risks. With personal attention and skill, Mick Quinn is waiting to help you protect yourself from the unexpected.

Call or email Mick Quinn's office to find out how you can benefit from State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Mick at (320) 843-3310 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.